Treatment GuideJust DiagnosedSex & DatingAfrican AmericanStigmaAsk the HIV DocPrEP En EspañolNewsVoicesPrint IssueVideoOut 100

CONTACTCAREER OPPORTUNITIESADVERTISE WITH USPRIVACY POLICYPRIVACY PREFERENCESTERMS OF USELEGAL NOTICE

© 2025 Pride Publishing Inc.

All Rights reserved

All Rights reserved

By continuing to use our site, you agree to our Privacy Policy and Terms of Use.

Worried about horror tales you've heard warning of people rejected for insurance coverage because they're HIV-positive? It's generally not an issue any longer'thanks to the Health Insurance Portability and Accountability Act of 1996. It is vital, however, that HIVers who switch from one form of health coverage to another understand how HIPAA protects them against discrimination. HIPAA prevents insurers from imposing any preexisting-condition restrictions on your care. If you are applying to purchase an individual insurance policy on the private market, every insurer must offer you a choice of at least two plans. However, the law does not limit the rates private insurers can charge. The most important thing to understand when starting a new job or shopping for private insurance is that HIPAA's protections are jeopardized if you become uninsured for 63 days or longer, but there is some wiggle room. For example, if your coverage has lapsed beyond 63 days, an employer-sponsored group plan (or a private plan in New York, New Jersey, Maine, or Vermont) can restrict your HIV care only for the amount of time you were uninsured'up to one year. Most private carriers in other states will automatically reject you if you lapse. For more information visit www.cms.hhs.gov/hippa.

From our Sponsors

Most Popular

BREAKING: Supreme Court rules to save free access to preventive care, including PrEP

June 27 2025 10:32 AM

Thanks to U=U, HIV-positive people can live long, happy, healthy lives

July 25 2025 2:37 PM

The Talk: Beyond the exam room

August 13 2025 3:15 PM

Plus: Featured Video

Latest Stories

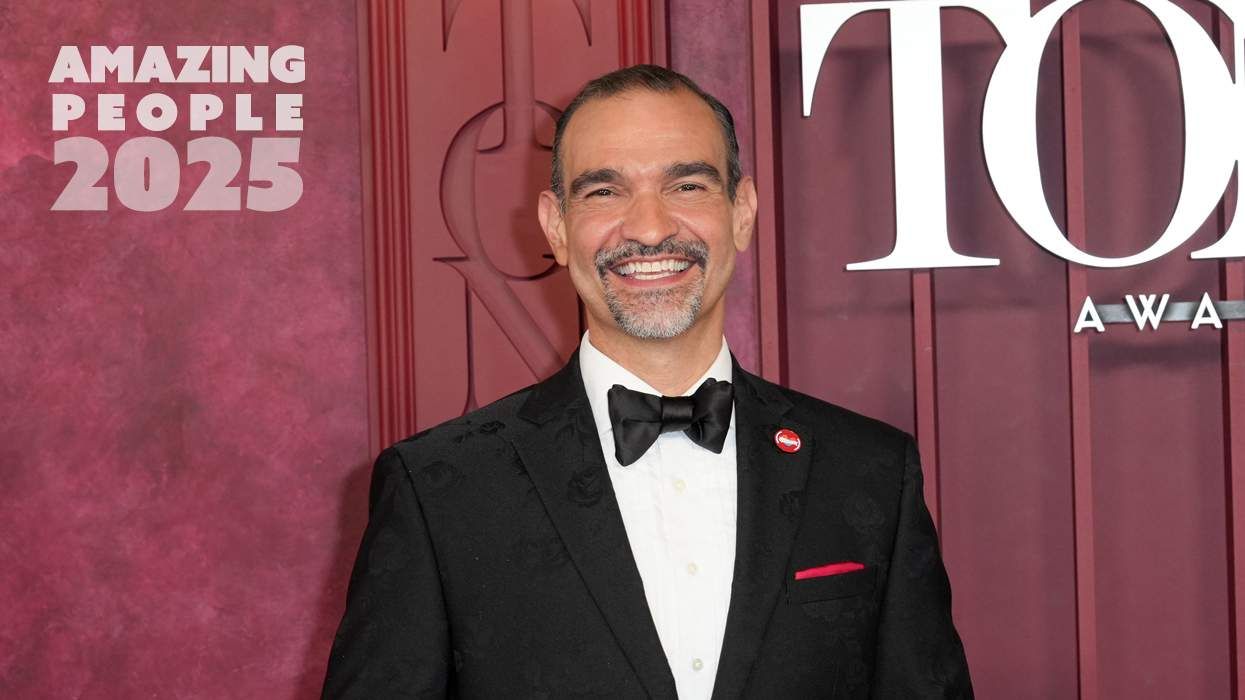

Amazing People of 2025: Javier Muñoz

October 17 2025 7:35 PM

It’s National PrEP Day! Learn the latest about HIV prevention

October 10 2025 9:00 AM

“I am the steward of my ship”: John Gibson rewrites his HIV narrative

September 16 2025 2:56 PM

“So much life to live”: Eric Nieves on thriving with HIV

September 03 2025 11:37 AM

The Talk: Owning your voice

August 25 2025 8:16 PM

The lab coat just got queer

August 21 2025 10:00 AM

Messenger RNA could be the key to an HIV vaccine — but government cuts pose a threat

August 20 2025 8:02 AM

The Talk: Navigating your treatment

August 01 2025 6:02 PM

The Talk: Starting the conversation

July 25 2025 4:47 PM

How the Black AIDS Institute continues to fill in the gaps

July 25 2025 1:06 PM

“I felt like a butterfly”: Niko Flowers on reclaiming life with HIV

July 23 2025 12:22 PM

Dancer. Healer. Survivor. DéShaun Armbrister is all of the above

July 02 2025 8:23 PM

1985: the year the AIDS crisis finally broke through the silence

June 26 2025 11:24 AM

VIDEO: A man living with HIV discusses his journey to fatherhood

June 10 2025 4:58 PM

Trump admin guts $258 million in funding for HIV vaccine research

June 03 2025 3:47 PM

Grindr is reminding us why jockstraps are so sexy and iconic

May 02 2025 5:36 PM

HRC holds 'die-in' to protest Trump health care cuts

April 28 2025 2:11 PM

Two right-wing Supreme Court justices signal they may uphold access to PrEP and more

April 21 2025 4:10 PM