New York Life Insurance Company, one of the world’s largest life insurers, is launching a program this month to assist HIV-positive individuals in planning for their financial future and retirement.

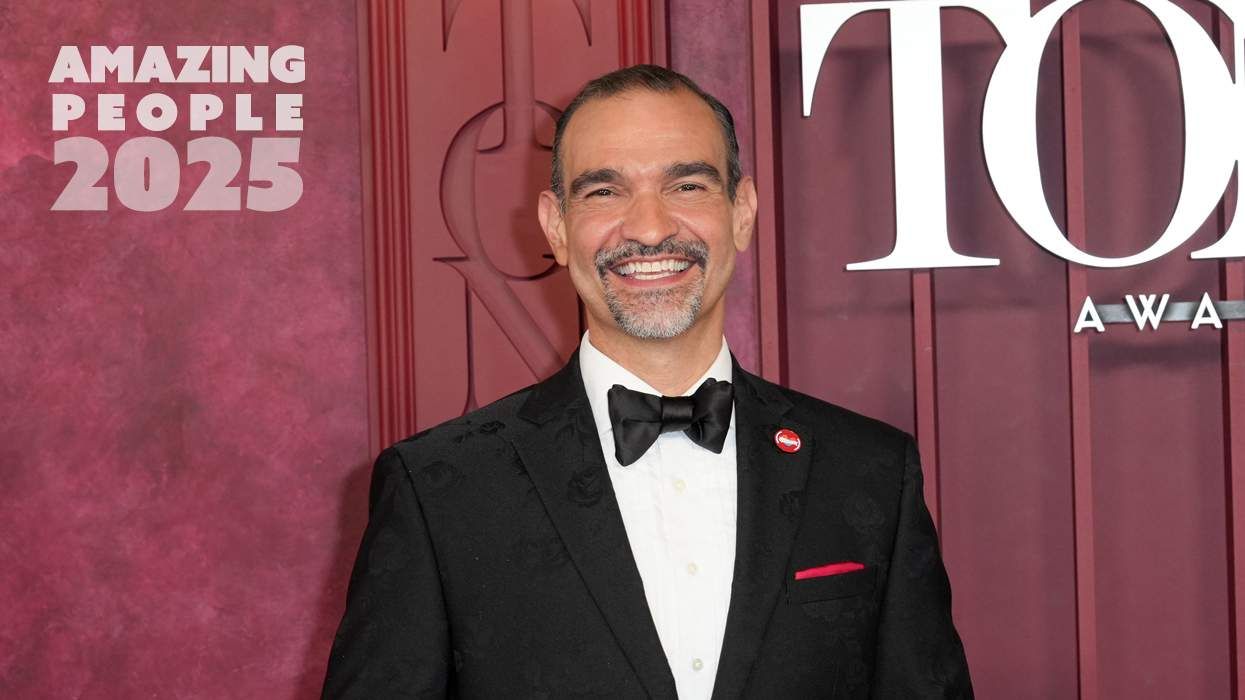

Titled “Positive Planning,” this first-of-its-kind program is being helmed by Aaron Baldwin, an HIV-positive agent based in New York Life’s San Francisco office, as well as managing partner Kevin Choi and Anthony Conde, the senior director of development for the Los Angeles general office.

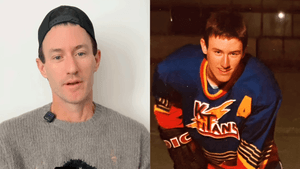

For Baldwin, 46, the decision to launch this new project seemed like a natural extension of the Fortune 100 company’s mission, which is “to provide financial security and peace of mind through our insurance, annuity and investment products, and services,” according to its website.

“In conversation with people living in the [positive] community, it became obvious that there was a need for this type of planning, because they deal with unique situations,” says Baldwin, pointing to issues such as ineligibility for health insurance and high medical expenses as long-standing obstacles to long-term care for HIV-positive individuals. “They could wind up potentially losing their estate in the process of attempting to manage their long-term care expenses.”

Beginning this month, Baldwin will begin a training program for 11,000 New York Life agents, which will provide education of the unique situations faced by HIV-positive clients. The company will facilitate much of this training through “webinars,” or online seminars, for agents across the United States as well as for the company’s employees and management. By educating agents, Baldwin hopes to be able to pass on knowledge and protections to HIV-positive clients and the larger community.

The Centers for Disease Control and Prevention predicts that over 50% of the HIV-positive population will be over 50 years old by 2015. Over the past two decades, developments in science and medicine have given the gift of longevity to people with HIV, who, as a result, may be financially and mentally unprepared for the rising costs of growing older.

“For many years, the community has spent money as if none of us would make it to retirement,” Baldwin says. “And, obviously, now we’re seeing that the mortality rate, if you adhere to the drug regimen, is pretty much normal. ‘No plans for planning’ no longer works. [So we have to ask ourselves:] How are we, as a community, going to absorb all of these people who begin to retire and are basically not prepared for retirement?”

Although agents have historically struggled with providing services to HIV-positive clients, the reality of longevity evidenced by these statistics has created an evolving playing field, where new services and opportunities are continually becoming available. If, as Baldwin hopes, health care providers begin to acknowledge HIV as a chronic illness like diabetes rather than a terminal condition, these opportunities may multiply 10-fold.

“At one time, diabetes was an uninsurable condition to have, but we know that, with years and years of understanding the condition, it’s easier to provide protection,” says Baldwin, referring to life insurance opportunities offered by AARP to LGBT seniors as one example of a possible new benefit. “As a company, we want to make sure that we stay on the forefront of what our clients are needing. And since we work in the community as much as we have been, we see this as an opportunity to educate people as to what might be available.”

As an HIV and AIDS activist for 20 years, Baldwin, who has been HIV-positive for 12 years, has been on the front lines for the fight for both survival and systemic change. He sees the next natural step for this battle as financial health, which will not only pay for cost of living and medical expenses in the long term as well as retirement, but also provide an individual with legacy after death.

Conde, the LGBT marketing director for New York Life and a collaborator with Baldwin on the “Positive Planning” program, also cites to legacy and community as key components to the initiative.

“When I lost my family to coming out as a gay man, I didn’t lose a family per se, because I gained the LGBT family,” Conde says. “We’re trying to leave that same legacy to our LGBT family. … I know so many individuals who are suffering with HIV but know that they want to leave their legacy to help other people who are suffering with the disease — people they don’t even know.”

“Planning has always been about finding the right financial tools and processes to do two things: protect your assets and leave a legacy,” he adds. “And that’s what it’s really all about.”

Currently, Conde and Baldwin are working with the government and various nonprofits to ensure that the program can provide the greatest amount of protection to HIV-positive people. The individuals and groups that New York Life has reached out to during this process include California state senator Mark Leno’s staff, activist Cleve Jones, Neil Giuliano of the San Francisco AIDS Foundation, and local LGBT organizations and service centers.

Understanding the resources available in an one’s local community is essential to New York Life’s outreach program, says Conde, and information about such resources is part of the training and education that will be given to agents. But ultimately, the path to long-term financial health begins with the individual.

“Individually, it all starts with having that financial conversation with yourself,” Conde says. “If you’re in a relationship, you’ll want to have it with your partner. If you need help, seek out a more knowledgeable person, be it a financial rep or an attorney, or a service that’s local.”

“It’s going to force you to have some conversations about retirement,” Baldwin adds. “When? Where? What type of lifestyle? What do you think you’re going to need to maintain that lifestyle throughout your retirement?”

And how will he know if “Positive Planning” is a success?

“Success comes with a greater knowledge of the fact that we, as a community, are changing,” Baldwin says. “This big dark cloud that has been over the community the past 30-plus years is starting to move again. What used to be considered a terminal condition is now a chronic condition, a condition that one can live with, a condition that one has to prepare for. … This is a condition that you may live with all your life, but your life may be as long, as fruitful, and as wonderful as anybody else’s.”

“But you have to plan for that,” he concludes.